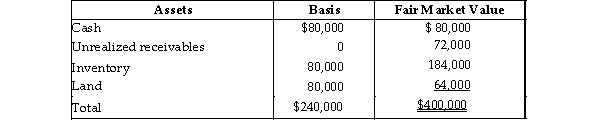

Tony sells his one- fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:  The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

Definitions:

Immediately Hire

The urgent employment of an individual or personnel without typical delays.

Confidential Information

Any information that is not publicly disclosed and is protected due to its sensitive nature or potential value.

Termination

The act of bringing an end to something, such as a contract, employment, or operation.

Breach

The violation or infringement of a law, obligation, standard, or agreement.

Q5: If the prepaid forward contract on a

Q9: Explain how a long stock and long

Q13: The premium on a call option on

Q14: Farmer Jayne decides to hedge 10,000 bushels

Q15: A farmer sells 4 million bushels of

Q20: Where must a tax researcher look to

Q38: Identify which of the following statements is

Q45: Abby transfers $10,000 to a political organization

Q72: The XYZ Partnership owns the following assets

Q96: Identify which of the following statements is