David sells his one- third partnership interest to Diana for $60,000 when his basis in the partnership interest is

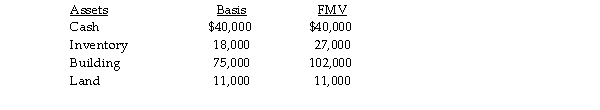

$48,000. On the date of sale, the partnership has no liabilities and the following assets:  The building is depreciated on a straight- line basis. What tax issues should David and Diana consider with resp to the sale transaction?

The building is depreciated on a straight- line basis. What tax issues should David and Diana consider with resp to the sale transaction?

Definitions:

Registration Statement

A set of documents, including a prospectus, filed with a securities regulatory agency (such as the SEC in the U.S.) by a company intending to go public, disclosing essential financial and management information.

Rule 10b-5

A regulation under the Securities Exchange Act of 1934 prohibiting any act or omission resulting in fraud or deceit in connection with the purchase or sale of any security.

1933 Securities Act

A federal statute enacted to govern the offer and sale of securities, aiming to ensure transparency and fairness in the securities market by requiring disclosures through registration of securities.

Material Fact

A crucial piece of information that can affect the outcome of a legal decision or the valuation of an investment.

Q6: A firm with assets value at $200,000

Q8: Describe the appeals process in tax litigation.

Q10: A firm with assets value at $20

Q15: The use of collars in acquisitions serves

Q25: Compare the tax treatment of administration expenses

Q36: Susan contributed land with a basis of

Q54: What is an electing large partnership? What

Q55: Karen died on May 5 of the

Q85: Which of the following is deductible in

Q107: Wally died on November 15. His gross