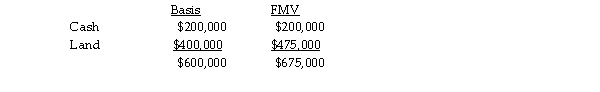

Sean, Penelope, and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000. In the following year, Penelope sold her one- third interest to Pedro for $225,000. At the time o the sale, the SPJ partnership had the following balance sheet:  Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a Section 754 election?

Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a Section 754 election?

Definitions:

Lockbox System

A service offered by banks to companies for the collection of payments from customers, involving the customers sending their payments to a special post office box.

Net Present Value

A technique utilized in the process of capital budgeting to assess an investment's profitability by determining the difference between the present value of cash inflows and outflows.

Treasury Bills

Short-term government securities with maturation periods of one year or less, considered a safe and liquid investment option.

Opportunity Costs

The cost of missing out on the next best alternative when making a decision.

Q7: What is the difference between a standard

Q22: The annualized dividend yield on the S&P

Q35: The definition of "unrealized receivable" does not

Q38: Jennifer and Terry, a married couple, live

Q39: Steve sells his 20% partnership interest having

Q51: A trust reports the following results: <img

Q54: Which of the following citations denotes a

Q60: The election of Subchapter S status by

Q82: Identify which of the following statements is

Q101: Kenya sells her 20% partnership interest having