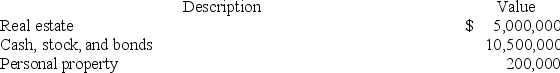

At his death in 2019,Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million,at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million).Nathan has never been married.What is the amount of his estate tax due? (Use Exhibit 25-1.)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million,at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million).Nathan has never been married.What is the amount of his estate tax due? (Use Exhibit 25-1.)

Definitions:

Psychotherapy

A form of treatment for mental and emotional disorders using psychological techniques designed to encourage communication and insight.

Clinical Psychologist

An expert trained in identifying and managing psychological, emotional, and behavioral issues using therapeutic methods and psychological interventions.

Excessive Anxiety

A heightened state of worry, nervousness, or unease that is disproportionate to the actual likelihood or impact of the feared event or situation.

Taste Sensitivity

The ability or capacity to perceive and differentiate the flavors of different substances.

Q5: At her death Serena owned real estate

Q36: Isaac is married and Isaac and his

Q38: In a query of two or more

Q48: What is the role of the operations

Q50: Under the book value method of allocating

Q77: Which of the following is not a

Q88: Which of the following is not a

Q89: A trust is a legal entity whose

Q94: An S corporation shareholder's allocable share of

Q105: Partners adjust their outside basis by adding