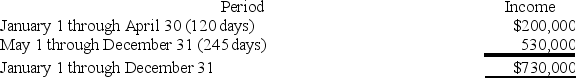

ABC was formed as a calendar-year S corporation with Alan,Brenda,and Conner as equal shareholders.On May 1,2019,ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation,Conner,Inc.ABC reported business income for 2019 as follows: (Assume that there are 365 days in the year.)

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31),how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2019?

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31),how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2019?

Definitions:

Contract Formats

Various structures and designs of legal agreements, documenting differing conditions and terms applicable to the specific agreements between parties.

Select a Strategy

involves choosing a specific plan or approach in order to achieve a goal or solve a problem.

Intervention

An action or process of intervening, which often implies stepping into a situation to change the outcome or influence the course of events, typically with the aim of improving or helping.

Planning Process

A systematic series of steps designed to develop strategies for achieving defined objectives.

Q9: Dependencies are reflected in the Gantt chart

Q11: Deductible interest expense incurred by a U.S.corporation

Q13: What is the advantage of using a

Q37: Which of the following is true concerning

Q69: Which of the following items is not

Q72: Which of the following best describes the

Q76: Generally,before gain or loss is realized for

Q78: Temporary differences that are cumulatively "favorable" are

Q90: Zhao incorporated her sole proprietorship by transferring

Q102: Partnership tax rules incorporate both the entity