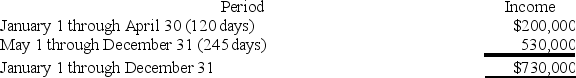

ABC was formed as a calendar-year S corporation with Alan,Brenda,and Conner as equal shareholders.On May 1,2019,ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation,Conner,Inc.ABC reported business income for 2019 as follows: (Assume that there are 365 days in the year.)

If ABC uses the specific identification method to allocate income,how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income,how much will it allocate to the S corporation short year and C corporation short year?

Definitions:

Scatter Diagram

A type of graph used in statistics to display values for two variables for a set of data, showing the relationship between the variables.

Linear Model

A statistical model assuming a linear relationship between the input variables (predictors) and a single output variable.

Income

The financial gain received by an individual or entity, usually through wages, investments, or business operations.

Least Squares Regression Line

A straight line that minimizes the sum of the squared differences between observed and predicted values in a dataset.

Q8: What is a dependency between two tasks?

Q15: Which of the following amounts is not

Q19: Bobby T (75 percent owner)would like to

Q25: The resource sheet allows you to enter

Q30: Suppose Clampett,Inc.,terminated its S election on August

Q33: Which of the following regarding the state

Q34: What form does a partnership use when

Q38: Gouda,S.A.,a Belgian corporation,received the following sources of

Q70: Which of the following statements is true

Q93: In the sale of a partnership interest,a