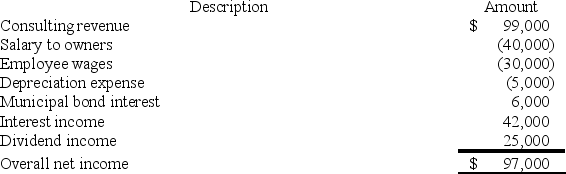

RGD Corporation was a C corporation from its inception in 2014 through 2018.However,it elected S corporation status effective January 1,2019.RGD had $50,000 of earnings and profits at the end of 2018.RGD reported the following information for its 2019 tax year.

What amount of excess net passive income tax is RGD liable for in 2019? Assume the corporate tax rate is 21%.

What amount of excess net passive income tax is RGD liable for in 2019? Assume the corporate tax rate is 21%.

Definitions:

Economic Output

The total value of all goods and services produced within an economy over a specific time period.

Potentially Efficient

A condition where resources could be allocated in a way that maximizes the net benefits to society, although it may not necessarily be achieved.

Empirical Economics

The study of economics based on the collection and analysis of data, emphasizing the role of observation and experimentation in understanding economic principles.

Economic Theories

These are frameworks or models that explain how economic processes work and predict how economies will respond to certain actions.

Q3: Temporary differences create either a deferred tax

Q4: For the holidays,Samuel gave a necklace worth

Q20: Publicly traded companies usually file their financial

Q35: Interest and dividends are allocated to the

Q36: The tax basis of property received by

Q44: A cumulative financial accounting (book)loss over three

Q54: Reno Corporation,a U.S.corporation,reported total taxable income of

Q64: Frank and Bob are equal members in

Q81: For partnership tax years ending after December

Q104: Mighty Manny,Incorporated,manufactures and services deli machinery and