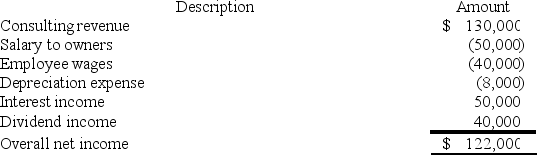

RGD Corporation was a C corporation from its inception in 2015 through 2018.However,it elected S corporation status effective January 1,2019.RGD had $50,000 of earnings and profits at the end of 2018.RGD reported the following information for its 2019 tax year.

What amount of excess net passive income tax is RGD liable for in 2019? (Round your answer for excess net passive income to the nearest thousand.)

What amount of excess net passive income tax is RGD liable for in 2019? (Round your answer for excess net passive income to the nearest thousand.)

Definitions:

Red Bone Marrow

A type of bone marrow that produces blood cells, located in the spongy bone.

Thymus

A small organ located in the upper chest, crucial for the development of the immune system's T cells during early life.

Lymph Nodes

Small, bean-shaped structures that are part of the body’s immune system, trapping pathogens and foreign particles.

Tonsils

Masses of lymphoid tissue located at the back of the throat that help protect the body from infection and play a role in the immune system.

Q6: Assume that at the end of 2019,Clampett,Inc.(an

Q8: As part of its uncertain tax position

Q8: Explain why partners must increase their tax

Q41: Bruin Company reports current E&P of $200,000

Q47: Marty is a 40 percent owner of

Q54: A gift tax return does not need

Q57: Sunapee Corporation reported taxable income of $700,000

Q66: Potter,Inc.reported pretax book income of $5,000,000.During the

Q81: A stock redemption is always treated as

Q83: Tax considerations are always the primary reason