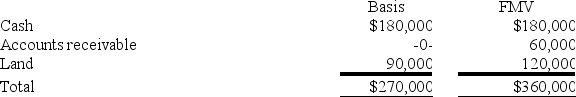

The SSC,a cash-method partnership,has a balance sheet that includes the following assets on December 31 of the current year:  Susan,a one-third partner,has an adjusted basis of $90,000 for her partnership interest.If Susan sells her entire partnership interest to Emma for $100,000 cash,what is the amount and character of Susan's gain or loss from the sale?

Susan,a one-third partner,has an adjusted basis of $90,000 for her partnership interest.If Susan sells her entire partnership interest to Emma for $100,000 cash,what is the amount and character of Susan's gain or loss from the sale?

Definitions:

Indirect Pay

Compensation that is not paid directly as cash but includes benefits like health insurance, retirement plans, and paid time off.

Health Care Spending Accounts

Accounts that allow employees to set aside pre-tax dollars to pay for eligible health care expenses not covered by their insurance.

Fixed Benefits Plan

A type of employee benefits plan where the benefits provided are predetermined and not based on individual performance or company profitability.

Defined Benefit Plan

A pension plan that guarantees a specified monthly benefit at retirement, which is predetermined by a formula based on the employee's earnings history, tenure of service, and age.

Q13: To meet the control test under §351,taxpayers

Q14: Which of the following statements is false

Q36: Isaac is married and Isaac and his

Q40: The term "E&P" is well-defined in the

Q42: Under what conditions will a partner recognize

Q53: Joan is a 30 percent partner in

Q68: The primary purpose of state and local

Q85: Antoine transfers property with a tax basis

Q98: Gordon operates the Tennis Pro Shop in

Q123: Distributions to owners may not cause the