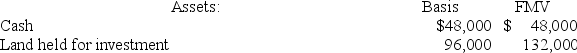

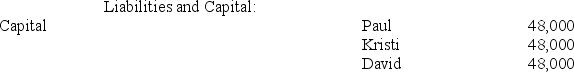

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000.Just prior to the sale,Paul's outside and inside bases in KDP are $48,000.KDP's balance sheet includes the following:

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

Definitions:

Sales Revenues

The income that a company receives from its normal business activities, usually from the sale of goods and services to customers.

Unit Sales

The quantity of items sold or number of services rendered over a given period.

Market Share Objective

A strategic business goal aimed at controlling a certain percentage of the market within a specific time.

Industry Sales

The total volume of products sold or services provided within a specific industry over a given period of time.

Q5: Corporations calculate adjusted gross income (AGI)in the

Q17: A rectangle with a triangle within it

Q36: The tax basis of property received by

Q56: TarHeel Corporation reported pretax book income of

Q81: Rachelle transfers property with a tax basis

Q86: Which of the following isn't a criterion

Q88: Neal Corporation was initially formed as a

Q96: Angel Corporation reported pretax book income of

Q100: Knollcrest Corporation has a cumulative book loss

Q110: An applicable credit is subtracted in calculating