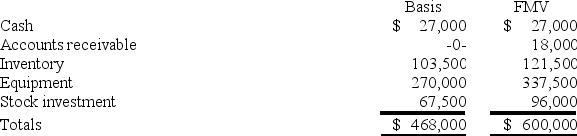

Victor is a one-third partner in the VRX Partnership,with an outside basis of $156,000 on January 1.Victor sells his partnership interest to Raj on January 1 for $200,000 cash.The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation.The stock was purchased seven years ago.What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation.The stock was purchased seven years ago.What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Positive Economic Statement

An objective statement that can be tested or validated through data, as opposed to a normative statement which is subjective and opinion-based.

Normative Statement

A statement that expresses a value judgment or opinion, suggesting how things should be rather than stating factual evidence.

Moral Judgment

The process of determining the rightness or wrongness of actions, often based on ethical principles.

Opportunity Costs

The cost of missing out on the top alternative by deciding on another option.

Q6: Congress reduced the corporate tax rate from

Q9: Sue and Andrew form SA general partnership.Each

Q12: The same exact requirements for forming and

Q15: Townsend Corporation declared a 1-for-1 stock split

Q47: Frost Corporation reported pretax book income of

Q50: Which of the following statements best describes

Q54: In an operating distribution,when a partnership distributes

Q57: Sarah is a 50 percent partner in

Q73: Walloon,Inc.reported taxable income of $1,000,000 in 20X3

Q85: Kim received a one-third profits and capital