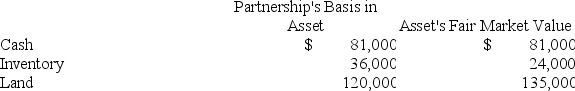

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $20,000.On that date,she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Desk

A piece of furniture with a flat top and legs, used for writing, working or using a computer.

Box of Tools

Metaphorically refers to a set of skills, strategies, or resources available to individuals or organizations for performing tasks or solving problems.

Economic Goods

Items or services that have a price and are scarce in relation to their demand, thus necessitating economic decision-making.

Scarce Resources

Raw materials, labor, and capital that are limited in availability, requiring societies to make decisions on their allocation and use.

Q9: Which of the following statements is correct

Q12: A unitary-return group includes only companies included

Q26: Which of the following does NOT create

Q27: If an S corporation shareholder sells her

Q48: Orchard,Inc.reported taxable income of $800,000 in 20X3

Q51: Phillip incorporated his sole proprietorship by transferring

Q51: Geneva Corporation,a privately held company,has one class

Q54: Reno Corporation,a U.S.corporation,reported total taxable income of

Q56: In January 2018,Khors Company issued nonqualified stock

Q91: Which of the following statements regarding book-tax