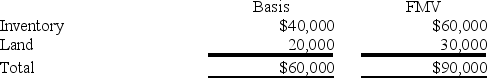

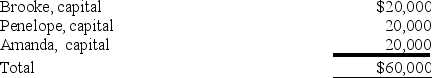

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000.BPA reports the following balance sheet:

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

b.Are these assets "hot" for purposes of distributions?

c.If BPA distributes the land to Brooke in complete liquidation of her partnership interest,what tax issues should be considered?

Definitions:

Rights Offering

A method by which a company raises additional capital by giving existing shareholders the right to buy new shares at a discount.

Subscription Price

The fee that investors pay when subscribing to a new issue of securities.

Market Price

This refers to the current price at which an asset or service can be bought or sold in the market.

Dutch Auction

A method for pricing shares (or other assets) where the price is reduced until all offered shares are sold to bidders, effectively finding the market clearing price.

Q11: At her death Tricia owned a life

Q26: This year,Reggie's distributive share from Almonte Partnership

Q27: If an S corporation shareholder sells her

Q46: Partners must generally treat the value of

Q50: For an S corporation shareholder to deduct

Q51: If Annie and Andy (each a 30

Q62: If a corporation's cash charitable contributions exceed

Q76: Which of the following statements is true?<br>A)In

Q83: For Corporation P to file a consolidated

Q96: Evergreen Corporation distributes land with a fair