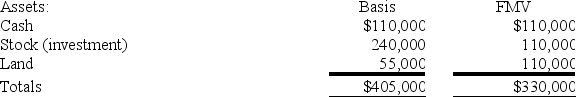

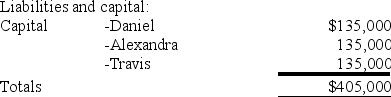

Daniel's basis in the DAT Partnership is $135,000.DAT distributes its land to Daniel in complete liquidation of his partnership interest.DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place,what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place,what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Activity-Based Costing

A pricing strategy that recognizes various tasks within a company and allocates the expenses of each task to all goods and services based on their real usage.

Customer Support

The range of services provided to assist customers in making cost-effective and correct use of a product, including assistance in planning, installation, training, troubleshooting, maintenance, and upgrading.

Time-Driven

Refers to processes or activities that are initiated, controlled, or measured based on time criteria.

Activity-Based Costing

An accounting methodology that assigns costs to products and services based on the resources they consume, providing more accurate cost information.

Q12: Jessica is a 25 percent partner in

Q15: Which of the following taxes would not

Q20: The gross profit from a sale of

Q43: The state tax base is computed by

Q60: Lola is a 35 percent partner in

Q67: A shareholder will own the same percentage

Q76: Nicole is a citizen and resident of

Q88: Which of the following amounts is not

Q92: Which of the following statements regarding excess

Q99: ASC 740 deals with accounting for uncertain