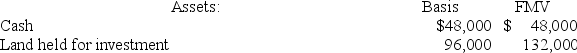

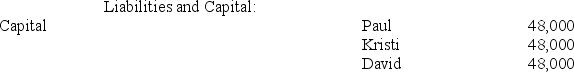

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000.Just prior to the sale,Paul's outside and inside bases in KDP are $48,000.KDP's balance sheet includes the following:

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

If KDP has a §754 election in place,what is Kathy's special basis adjustment?

Definitions:

Desertion

The act of abandoning a duty or post, especially in military service, without permission and with no intention of returning.

Union Army

The land force that fought for the Northern states during the American Civil War.

Confederate Army

The military ground forces of the Confederate States of America during the American Civil War, fighting against the Union.

Wartime Presidents

Leaders who served as the head of a country during periods of conflict, charged with making critical decisions about national security, military strategy, and domestic wartime measures.

Q9: Gary and Laura decided to liquidate their

Q16: Abbot Corporation reported a net operating loss

Q36: Which of the following statements best describes

Q43: Randolph is a 30 percent partner in

Q57: Sarah is a 50 percent partner in

Q70: Hector formed H Corporation as a C

Q79: Madison Corporation reported taxable income of $400,000

Q88: A distribution from a corporation to a

Q88: Which of the following amounts is not

Q96: Unlike in partnerships,adjustments that decrease an S