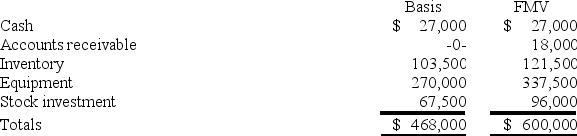

Victor is a one-third partner in the VRX Partnership,with an outside basis of $156,000 on January 1.Victor sells his partnership interest to Raj on January 1 for $200,000 cash.The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation.The stock was purchased seven years ago.What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation.The stock was purchased seven years ago.What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Task-Work Skills

The abilities and competencies required to effectively perform specific tasks in a work setting.

Teamwork Skills

Teamwork skills involve the ability to work effectively and collaboratively with others to achieve a common goal, encompassing communication, cooperation, and conflict resolution.

Computer Skills

The ability to use computers and related technology efficiently, with a range of skills covering programming, software use, and the ability to utilize computer applications effectively.

Technical Skills Training

Instruction aimed at imparting specific skills and knowledge needed to perform particular tasks or jobs, especially relating to technology or applied sciences.

Q27: Big Company and Little Company are both

Q49: SEC Corporation has been operating as a

Q50: Christopher's residence was damaged by a storm

Q50: Ted is a 30 percent partner in

Q64: Businesses must collect sales tax only in

Q66: A C corporation reports its taxable income

Q70: The sales and use tax base varies

Q84: Tyson,a one-quarter partner in the TF Partnership,receives

Q97: Gary and Laura decided to liquidate their

Q105: Partners adjust their outside basis by adding