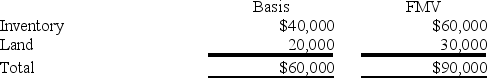

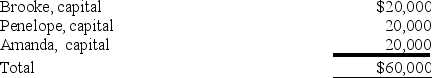

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000.BPA reports the following balance sheet:

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

a.Identify the hot assets if Brooke decides to sell her interest in BPA.

b.Are these assets "hot" for purposes of distributions?

c.If BPA distributes the land to Brooke in complete liquidation of her partnership interest,what tax issues should be considered?

Definitions:

Market Portfolio

A theoretical bundle of investments that includes all types of assets available in the financial market, with each asset weighted according to its market capitalization.

No-Arbitrage Condition

A principle asserting that equivalent assets or combinations of assets should have the same price to prevent the possibility of risk-free profit through arbitrage.

Well-Diversified Portfolios

Investment portfolios that are spread across various assets to minimize exposure to any single asset or risk.

Q14: The recipient of a taxable stock distribution

Q25: Tax elections are rarely made at the

Q32: ABC Corp.elected to be taxed as an

Q49: SEC Corporation has been operating as a

Q63: Which of the following statements regarding nonqualified

Q71: A corporation's effective tax rate as computed

Q82: ASC 740 is the sole source of

Q90: This year Truckit reported taxable income of

Q106: Assume that at the end of 2019,Clampett,Inc.(an

Q109: Gordon operates the Tennis Pro Shop in