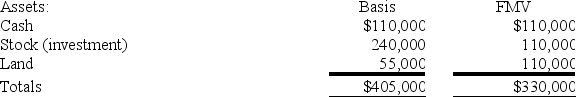

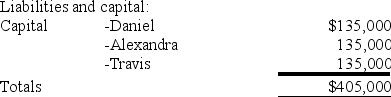

Daniel's basis in the DAT Partnership is $135,000.DAT distributes its land to Daniel in complete liquidation of his partnership interest.DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place,what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place,what is the amount and sign (positive or negative)of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Printing

The process of reproducing text and images, typically with ink on paper using a printing press or a printer.

Monetary Products

typically refers to financial products or instruments that are directly related to money or the management of money, such as currency, loans, and investment vehicles; however, this term is not widely used in formal economic contexts and might be considered non-standard.

Round Off

The process of adjusting numbers to their nearest value according to a specific base.

Multiply

The mathematical operation of increasing one number by another to get a product.

Q3: All taxes paid to a foreign government

Q9: Appleton Corporation,a U.S.corporation,reported total taxable income of

Q36: Delivery of tangible personal property through common

Q54: Which of the following items does not

Q68: Obispo,Inc.,a U.S.corporation,received the following sources of income:<br>$20,000

Q79: Which of the following statements exemplifies the

Q86: Simone transferred 100 percent of her stock

Q90: This year Truckit reported taxable income of

Q91: Which of the following statements regarding book-tax

Q107: Which of the following is not a