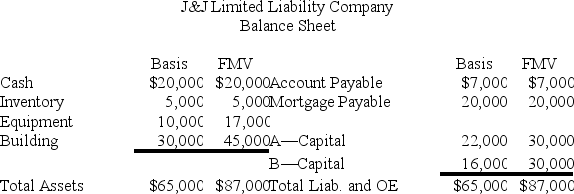

J&J,LLC,was in its third year of operations when J&J decided to expand the number of members from two,A and B,with equal profits and capital interests,to three members,A,B,and C.The third member,C,will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted,what are the tax consequences to members A,B,and C,and to J&J,when C receives her capital interest? If,instead,member C receives a one-third profits interest,what would be the tax consequences to members A,B,and C,and to J&J?

Definitions:

Educational Strengths

Positive attributes or competencies demonstrated in a learning context, such as critical thinking or subject-matter expertise.

Professional Strengths

Skills and abilities that contribute to superior performance in a professional environment.

Current Employer

The organization or person for whom one is presently working.

Success Story

A narrative that outlines significant achievements or positive outcomes, typically used to illustrate effectiveness or impact.

Q8: Windmill Corporation,a Dutch corporation,is owned by the

Q15: From a tax perspective,which entity choice is

Q24: Although a corporation may report a temporary

Q25: If a C corporation incurs a net

Q49: Boomerang Corporation,a New Zealand corporation,is owned by

Q59: At the end of last year,Cynthia,a 20

Q66: An S corporation shareholder who is not

Q71: Which of the following statements regarding a

Q77: Jamie transferred 100 percent of her stock

Q127: Clampett,Inc.,has been an S corporation since its