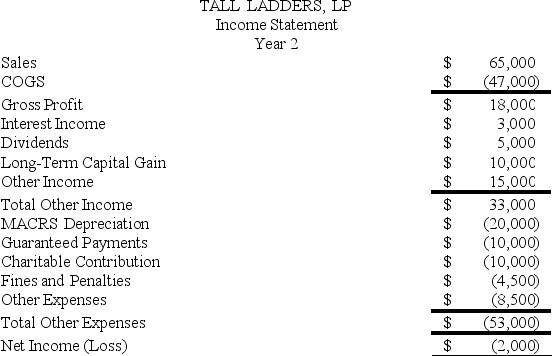

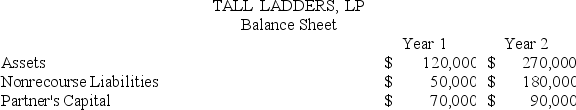

At the end of Year 1,Tony had a tax basis of $40,000 in Tall Ladders,Limited Partnership.Tony has a 20 percent profits interest in Tall Ladders.For Year 2,Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership.Given the following income statement and balance sheet from Tall Ladders,what is Tony's adjusted tax basis at the end of Year 2?

Definitions:

Competitive Strategies

Approaches that organizations use to gain a competitive advantage in the market, differentiating themselves from competitors.

Low-Cost Provider

A business strategy aiming to achieve competitive advantage by offering products or services at lower prices than competitors.

Market Niche

A specific segment of a market targeted by a business, where specialized products or services are offered to meet the particular needs or preferences of a defined set of customers.

Gourmet Salad Dressings

High-quality, often handcrafted or uniquely flavored salad dressings aimed at enhancing the culinary experience of salads.

Q4: The built-in gains tax does not apply

Q9: Stone Corporation reported pretax book income of

Q11: An S election is terminated if the

Q18: Tiger Corporation,a privately held company,has one class

Q39: If a partner participates in partnership activities

Q45: Mighty Manny,Incorporated,manufactures and services deli machinery and

Q63: In which type of distribution may a

Q76: Which of the following statements is true?<br>A)In

Q77: Kathy is a 25 percent partner in

Q107: SoTired,Inc.,a C corporation with a June 30