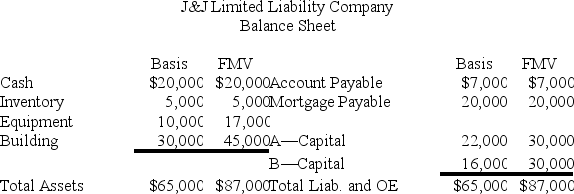

J&J,LLC,was in its third year of operations when J&J decided to expand the number of members from two,A and B,with equal profits and capital interests,to three members,A,B,and C.The third member,C,will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J.Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted,what are the tax consequences to members A,B,and C,and to J&J,when C receives her capital interest? If,instead,member C receives a one-third profits interest,what would be the tax consequences to members A,B,and C,and to J&J?

Definitions:

Fast Heartbeat

A condition, also known as tachycardia, where the heart rate is faster than normal, often due to stress, exercise, or medical conditions.

Dyspnea

Difficulty or discomfort in breathing, often described as shortness of breath.

Crescendo Angina

A form of angina that intensifies in severity or frequency, indicating a heightened risk of a heart attack.

I20.0

A diagnosis code referring to stable angina, a condition characterized by chest pain or discomfort due to coronary artery disease.

Q12: Jessica is a 25 percent partner in

Q21: The payroll factor includes payments to independent

Q31: Comet Company is owned equally by Pat

Q40: Smith Company reported pretax book income of

Q48: The "current income tax expense or benefit"

Q52: Scott is a 50 percent partner in

Q73: Walloon,Inc.reported taxable income of $1,000,000 in 20X3

Q81: Which of the following tax benefits does

Q84: Lefty provides demolition services in several southern

Q94: Styling Shoes,LLC,filed its 20X8 Form 1065 on