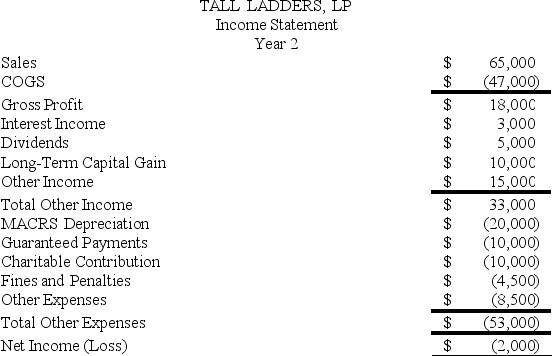

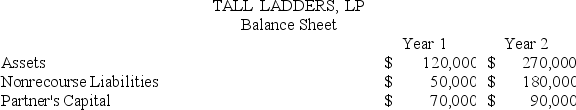

At the end of Year 1,Tony had a tax basis of $40,000 in Tall Ladders,Limited Partnership.Tony has a 20 percent profits interest in Tall Ladders.For Year 2,Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership.Given the following income statement and balance sheet from Tall Ladders,what is Tony's adjusted tax basis at the end of Year 2?

Definitions:

Heart Transplant

A surgical procedure that involves replacing a patient's failing or diseased heart with a healthy heart from a deceased donor.

Operations Management

The management domain that deals with the development, oversight, and control of manufacturing processes and the restructuring of business procedures in the production of goods or services.

Industrial Engineering

A branch of engineering that deals with the optimization of complex processes or systems, focusing on improving efficiency and productivity.

Management Science

A multidisciplinary approach to solving complex problems for businesses using analytical methods.

Q1: A corporation generally will report a favorable,temporary

Q10: Use tax liability accrues in the state

Q25: Sara owns 60 percent of the stock

Q28: Tennis Pro is headquartered in Virginia.Assume it

Q37: The deduction for qualified business income applies

Q41: A corporation undertakes a valuation allowance analysis

Q58: A distribution in partial liquidation of a

Q81: Grand River Corporation reported pretax book income

Q98: WFO Corporation has gross receipts according to

Q129: The IRS may consent to an early