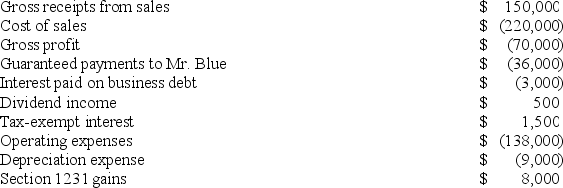

On January 1,20X9,Mr.Blue and Mr.Grey each contributed $100,000 to form the B&G General Partnership.Their partnership agreement states that they will each receive a 50 percent profits and loss interest.The partnership agreement also provides that Mr.Blue will receive an annual $36,000 guaranteed payment.B&G began business on January 1,20X9.For its first taxable year,its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

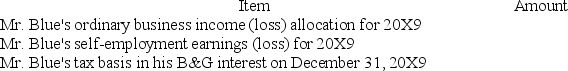

Complete the following table related to Mr.Blue's interest in B&G partnership:

Definitions:

Diminish

To decrease or make smaller in size, importance, or intensity.

Excludability

The characteristic displayed by those goods and services for which sellers are able to prevent nonbuyers from obtaining benefits.

Consuming

Consuming involves using up goods or services by purchasing, eating, or utilizing them to satisfy needs or wants.

Good

A material item or service that satisfies a need or desire and is available for purchase or trade.

Q9: Which of the following statements is correct

Q15: Assume Tennis Pro discovered that one salesperson

Q26: Commercial domicile is the location where a

Q27: General Inertia Corporation made a pro rata

Q37: Maria,a resident of Mexico City,Mexico,formed MZE Corp.in

Q39: Income that is included in book income,but

Q41: Bruin Company reports current E&P of $200,000

Q71: AIRE was initially formed as an S

Q99: Inca Company reports a deficit in current

Q115: Gordon operates the Tennis Pro Shop in