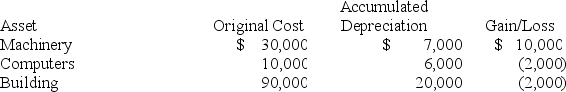

Brandon,an individual,began business four years ago and has never sold a §1231 asset.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Definitions:

Statute of Frauds

A legal provision requiring certain types of contracts to be written and signed to be enforceable.

Discharged Debt

A debt that has been fully paid off or legally settled, releasing the debtor from further obligations.

Bankruptcy

A legal process for individuals or businesses that cannot repay their outstanding debts, allowing them to be relieved of their debt obligations under the protection of law.

Industry Standards

Industry standards refer to the established norms and technical specifications followed by companies in a particular sector to ensure quality, safety, and interoperability.

Q2: If you were seeking an entity with

Q17: Which of the following is not a

Q21: Which tax classifications can potentially apply to

Q24: Selene made $54,300 in 2019 working at

Q32: Investment income includes:<br>A)interest income.<br>B)net short-term capital gains.<br>C)nonqualified

Q34: How are individual taxpayers' investment expenses and

Q36: Taxpayers use the half-year convention for all

Q49: Group-term life insurance is a fringe benefit

Q52: Bateman Corporation sold an office building that

Q71: The tax law places a fixed dollar