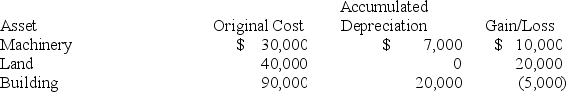

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last five years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Use dividends and capital gains tax rates for reference.

Definitions:

Overdetermined

A term used in psychoanalysis to describe a situation or symptom that is caused by several different factors or motives.

Automatic

Processes or responses that occur without conscious control or decision-making, often reflexive or habitual in nature.

Excessive Thought

Engaging in overly repetitive or non-productive thinking, often seen in anxiety or obsessive-compulsive disorders.

Nonviolent Pornography

describes explicit sexual material that does not depict violence or coercive acts, drawing distinctions based on the nature of the content.

Q13: Real property is depreciated using the straight-line

Q22: Shareholders of C corporations receiving property distributions

Q34: When a taxpayer borrows money and invests

Q40: When determining the number of days a

Q48: Which of the following is a true

Q69: Amelia is looking to refinance her home

Q81: Rayleen owns a condominium near Orlando,Florida.This year,she

Q86: Which of the following statements best describes

Q86: Employees are allowed to deduct a portion

Q97: The standard retirement benefit an employee will