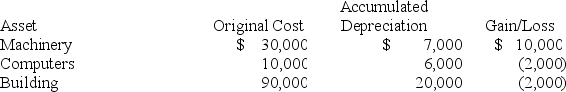

Brandon,an individual,began business four years ago and has never sold a §1231 asset.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Definitions:

Bulldozer

A heavy piece of equipment used in construction to move or remove large amounts of earth or debris, featuring a large flat blade.

Savings Bond

A government bond that offers a fixed interest rate over a fixed period of time, often considered a safe investment.

Production Possibilities Frontier

A curve depicting all maximum output possibilities for two or more goods given a set of inputs (resources, labor, etc.).

World War II

A worldwide war that spanned from 1939 to 1945, engaging the majority of the planet's countries, with all the major powers eventually splitting into two conflicting military coalitions: the Allies and the Axis.

Q23: What is the maximum amount of gain

Q45: Tatia,age 38,has made deductible contributions to her

Q46: In general,major integrated oil and gas producers

Q51: Which of the following statements regarding the

Q53: John is a self-employed computer consultant who

Q54: Individual proprietors report their business income and

Q61: In 2019,US Sys Corporation received $250,000 in

Q62: Bill operates a proprietorship using the cash

Q94: Sam is 30 years old.In 2019,he reported

Q99: Buzz Corporation sold an office building that