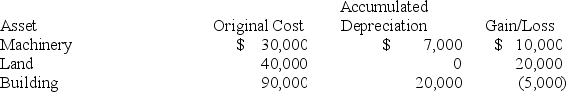

Brandon,an individual,began business four years ago and has sold §1231 assets with $5,000 of losses within the last five years.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Use dividends and capital gains tax rates for reference.

Definitions:

Net Sales

Total sales revenue minus returns, allowances, and discounts.

Gross Profit

Gross profit refers to the difference between revenue and the cost of goods sold before administrative, overhead, and other expenses.

Receivables Turnover Ratio

A financial metric that measures a company's effectiveness in extending credit and collecting debts, calculated by dividing net credit sales by the average accounts receivable.

Net Sales

The amount of sales revenue remaining after deducting returns, allowances for damaged or missing goods, and discounts.

Q7: Which of the following is not an

Q8: Depreciation recapture changes both the amount and

Q20: Jessica purchased a home on January 1,2019,for

Q45: Taxpayers renting a home would generally report

Q47: Which of the following statements regarding net

Q53: An employee's income with respect to restricted

Q75: Which of the following statements best describes

Q88: Tax cost recovery methods include depreciation,amortization,and depletion.

Q101: If a machine (seven-year property)being depreciated using

Q142: Montague (age 15)is claimed as a dependent