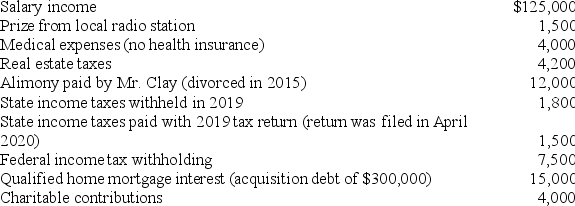

During all of 2019,Mr.and Mrs.Clay lived with their four children (all are under the age of 17).They provided over one-half of the support for each child.Mr.and Mrs.Clay file jointly for 2019.Neither is blind,and both are under age 65.They reported the following tax-related information for the year.(Use the tax rate schedules)

1.What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)

1.What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)

2.What are the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Physical Prompts

Physical cues or assistance given to someone to initiate or complete a task, often used in teaching new skills or behaviors.

Transition Time

The interval between activities or phases within an environment, often requiring special management in educational or therapeutic settings to maintain order and focus.

Time Management

The effective planning and controlling how much time to spend on specific activities to increase efficiency or productivity.

Classroom

A room or space specifically designated for teaching and learning activities.

Q15: Northern LLC only purchased one asset this

Q25: Amit purchased two assets during the current

Q43: For corporations,§291 recaptures 20 percent of the

Q46: Which of the following types of income

Q49: Gainesville LLC sold the following business assets

Q57: How is the recovery period of an

Q71: Given that losses from passive activities can

Q72: Businesses may immediately expense research and experimentation

Q94: Kristine sold two assets on March 20th

Q121: Interest income is taxed in the year