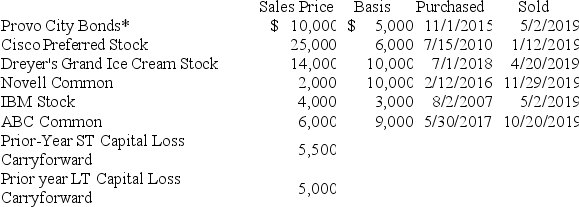

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City.

*Purchased when originally issued by Provo City.

What is the net short-term capital gain/loss reported on the 2019 Schedule D? What is the net long-term capital gain/loss reported on the 2019 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

Casting

A manufacturing process where a liquid material is poured into a mold, which contains a hollow cavity of the desired shape, and then allowed to solidify.

Assembly

The phase in manufacturing where components are put together to form a final product.

Predetermined Overhead Rates

Rates used to allocate manufacturing overhead costs to products or job orders, calculated based on estimated costs and activity levels.

Machine-Hours

A measure of production time that quantifies the number of hours machines are operated in the manufacturing process.

Q6: Illegal bribes and kickbacks are not deductible

Q30: The maximum amount of net capital losses

Q34: Long-term capital gains,dividends,and taxable interest income are

Q35: Which of the following types of transactions

Q60: Long-term capital gains (depending on type)for individual

Q70: Charles and Camilla got divorced in 2018.Under

Q70: Two advantages of investing in capital assets

Q74: Bryon operates a consulting business and he

Q76: All taxpayers may use the §179 immediate

Q110: Char and Russ Dasrup have one daughter,Siera,who