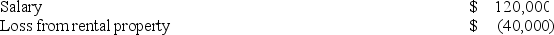

Judy,a single individual,reports the following items of income and loss:

Judy owns 100 percent of the rental property and actively participates in the rental of the property.Calculate Judy's AGI.

Judy owns 100 percent of the rental property and actively participates in the rental of the property.Calculate Judy's AGI.

Definitions:

Double-Declining-Balance

An accelerated method of depreciation which doubles the normal depreciation rate, reducing the asset's book value more quickly.

Resale Value

The estimated market value of an asset at the future point in time when it is likely to be sold.

Office Furniture

Items and accessories designed for use in an office environment, including desks, chairs, cabinets, and shelves.

Double-Declining-Balance

An accelerated method of depreciation that doubles the straight-line depreciation rate.

Q13: Real property is depreciated using the straight-line

Q24: The general rule regarding the exchanged basis

Q26: The phrase "ordinary and necessary" means that

Q40: Joanna received $60,000 compensation from her employer,the

Q47: The Internal Revenue Code of 1986 is

Q58: All of the following are for AGI

Q69: Fran purchased an annuity that provides $12,000

Q92: Brad operates a storage business on the

Q101: Which is not a basic tax planning

Q111: The amount of expenditures eligible for the