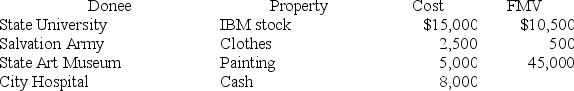

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Definitions:

Paralyzing Poison

A toxic substance that can cause immobilization by affecting the nervous system or muscular function.

ACh Antagonist

A compound that blocks the action of acetylcholine, a neurotransmitter involved in muscle action, heart rate, and other functions.

Endorphins

Neurotransmitters produced in the brain that act as natural painkillers and mood elevators, often released during exercise, excitement, and pain.

Jogging

A form of slow or leisurely running that aims to enhance physical fitness without causing extreme exhaustion.

Q22: In June of Year 1,Eric's wife,Savannah,died.Eric did

Q25: Michael,Diane,Karen,and Kenny provide support for their mother,Janet,who

Q25: Ranger Athletic Equipment uses the accrual method

Q31: The tax law defines alimony to include

Q55: Which of the following is not a

Q61: A taxpayer earning income in "cash" and

Q62: All capital gains are taxed at preferential

Q80: Littman LLC placed in service on July

Q89: Johann had a gross tax liability of

Q103: Realized income is included in gross income