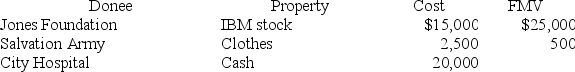

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock and painting have been owned for 10 years.

Definitions:

Low Unemployment

A situation where a very small percentage of the labor force is not engaged in gainful employment, indicating a healthy economy.

Protective Tariffs

Duties charged on imports to defend local sectors from international rivals by elevating the prices of goods from abroad.

Manufactured Goods

Products that have been processed or transformed from raw materials into finished items through the use of machinery or human effort.

Great Depression

A severe worldwide economic downturn that took place during the 1930s, marked by high unemployment, deflation, and a significant fall in economic output.

Q3: The method for tax amortization is always

Q8: Qualified dividends are always taxed at a

Q10: Compare and contrast the constructive receipt doctrine

Q15: Northern LLC only purchased one asset this

Q35: Which of the following types of transactions

Q41: Assuming an after-tax rate of return of

Q42: Michelle is an active participant in the

Q52: An individual could pay 100 percent of

Q76: Sally received $60,000 of compensation from her

Q76: George recently paid $50 to renew his