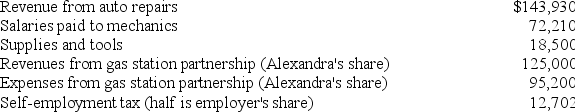

Alexandra operates a garage as a sole proprietorship.Alexandra also owns a half interest in a partnership that operates a gas station.This year Alexandra paid or reported the following expenses related to her garage and other property.Determine Alexandra's AGI for 2019.

Definitions:

Hawthorne Studies

A series of influential experiments in industrial organization conducted in the 1920s and 1930s at the Hawthorne Works in Chicago, highlighting the impact of work conditions on productivity.

World War II

A global conflict that lasted from 1939 to 1945, involving most of the world's nations, including all of the great powers, eventually forming two opposing military alliances: the Allies and the Axis.

Scarcity of Jobs

A situation in which there are fewer job opportunities available than there are people seeking employment, often leading to high competition for employment.

Sandwich Generation

Middle-aged adults who are taking responsibility for both dependent children and parents at the same time, and being sandwiched by these obligations.

Q15: The timing strategy is particularly effective for

Q20: Ed is a self-employed heart surgeon who

Q21: Adjusted taxable income is defined as follows

Q37: Tax avoidance is a legal activity that

Q39: Richard recently received $10,000 of compensation for

Q53: Lax LLC purchased only one asset during

Q90: Rob is currently considering investing in municipal

Q93: Acme published a story about Paul,and as

Q96: The IRS has recently completed its audit

Q134: Sheryl's AGI is $250,000.Her current tax liability