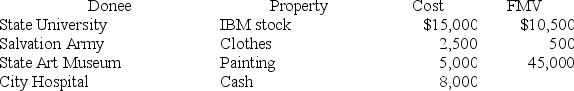

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year.You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Definitions:

Treasury Stock

Shares that were issued and later reacquired by the issuing corporation.

Additional Paid-In Capital

The excess amount paid by investors over the par value of shares during equity issuances, reflecting additional funding invested in the company.

Contra to Owners' Equity

An account that reduces the total amount of owners' equity, such as drawings or expenses subtracted from the capital account in a sole proprietorship or partnership.

Stockholders' Equity

Stockholders' equity represents the owners' equity invested in a company, inclusive of retained earnings and contributed capital, showing the residual assets available to shareholders after debts are settled.

Q8: If a married couple has one primary

Q34: Long-term capital gains,dividends,and taxable interest income are

Q39: Richard recently received $10,000 of compensation for

Q53: Investment interest expense is a for AGI

Q57: Which of the following expenditures is most

Q60: When does the all-events test under the

Q60: Tasha LLC purchased furniture (seven-year property)on April

Q64: Jane and Ed Rochester are married with

Q68: Sullivan's wife,Susan,died four years ago.Sullivan has not

Q112: Raul was researching an issue and found