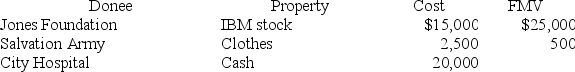

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock and painting have been owned for 10 years.

Definitions:

Difference Thresholds

the minimum difference in stimulus intensity required to detect a difference between two stimuli.

Clairvoyance

The supposed ability to gain information about an object, person, location, or physical event through extrasensory perception.

Extrasensory Perception

The supposed ability to gain information without the use of the known senses or through physical interaction.

Events

Occurrences or happenings that are distinctive and can be identified in time and space.

Q14: Assume that Keisha's marginal tax rate is

Q25: Which of the following describes how the

Q29: Bob operates a clothing business using the

Q32: Which is not an allowable method under

Q36: Only half the cost of a business

Q51: Maria and Tony are married.They are preparing

Q72: Cyrus is a cash method taxpayer who

Q99: For taxpayers who receive both salary as

Q113: In addition to the individual income tax,individuals

Q114: From AGI deductions are generally more valuable