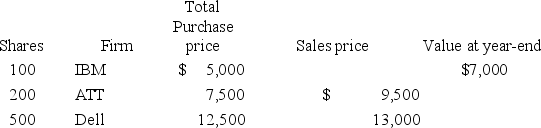

This year Ann has the following stock transactions.What amount is included in her gross income if Ann paid a $200 selling commission for each sale?

Definitions:

Different States

Refers to distinct regions or territories within a country, especially within the United States, each with its own governance and legal systems.

Exclusive Jurisdiction

The power of a court to adjudicate a case to the exclusion of all other courts.

Federal Copyright Cases

Legal proceedings that involve disputes over copyright infringement, ownership, and violation of copyright laws within federal jurisdiction.

Admiralty Cases

Legal issues and disputes related to maritime law and activities.

Q3: Joe operates a plumbing business that uses

Q7: Filing status determines all of the following

Q8: Which of the following is a true

Q32: Rodney,a cash-basis taxpayer,owes $40,000 in tax-deductible consulting

Q39: Rowanda could not settle her tax dispute

Q53: Sin taxes are:<br>A)taxes assessed by religious organizations.<br>B)taxes

Q60: Bill filed his 2019 tax return on

Q92: This year Henry realized a gain on

Q92: Common examples of sin taxes include the

Q141: Which of the following best describes the