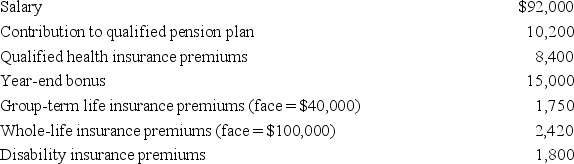

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness.During his illness Andres received $6,500 in sick pay from a disability insurance policy.Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit.What amount,if any,must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness.During his illness Andres received $6,500 in sick pay from a disability insurance policy.Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit.What amount,if any,must Andres include in gross income this year?

Definitions:

Q31: Rolando's employer pays year-end bonuses each year

Q45: The assignment of income doctrine is a

Q63: The investment interest expense deduction is limited

Q77: The Internal Revenue Code and tax treaties

Q80: Which of the following taxes will not

Q90: Werner is the president and CEO of

Q110: Business credits are generally refundable credits.

Q113: The city of Granby,Colorado,recently enacted a 1.5

Q123: Which of the following is not true

Q154: Generally,income from an active trade or business