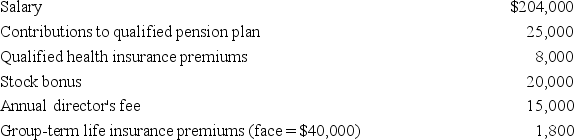

This year Joseph joined the board of directors for a company.Besides his director's fees,Joseph received the following employee benefits:

The stock bonus consisted of 5,000 shares of Bell stock given to Joseph as compensation.At the time of the transfer the stock was listed at $4 per share.What amounts,if any,should Joseph include in gross income this year?

The stock bonus consisted of 5,000 shares of Bell stock given to Joseph as compensation.At the time of the transfer the stock was listed at $4 per share.What amounts,if any,should Joseph include in gross income this year?

Definitions:

Year 2

Refers to the second year of a time-related context or sequence, not a standalone key term without additional context.

Contribution Margin

The amount of revenue remaining after subtracting variable costs, indicating how much contributes towards covering fixed costs and generating profit.

Per Unit

Refers to expressing costs, revenues, or other financial metrics on a per-unit basis to provide a standardized measure.

Absorption Costing

An accounting method that includes all manufacturing costs, both variable and fixed, in the cost of a product, and is used for external reporting purposes.

Q18: A taxpayer's at-risk amount in an activity

Q29: Josephine is considering taking a six-month rotation

Q46: Unused investment interest expense:<br>A)expires after the current

Q48: Which of the following is a true

Q49: Which of the following is a false

Q58: Oswald is beginning his first tax course

Q62: All capital gains are taxed at preferential

Q69: Fran purchased an annuity that provides $12,000

Q108: If Rudy has a 25 percent tax

Q109: Pam recently was sickened by eating spoiled