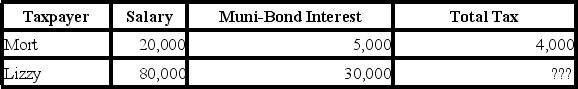

Given the following tax structure,what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Productivity

The measure of efficiency in converting inputs into useful outputs, commonly used to evaluate performance in work and processes.

Career Goals

Long-term objectives relating to a person's desired progression in their professional life.

Retirement

The act of leaving one's job and ceasing to work, typically due to reaching a certain age or for health reasons.

Intrasender Role Conflict

A situation where conflicting expectations arise from the same source, leading to tension and difficulty in role fulfillment.

Q4: Which of the following is most likely

Q7: The remnant of a ruptured follicle that

Q17: A person with O blood has<br>A) the

Q19: The component of a nephron that filters

Q41: For which of the following tax violations

Q75: An individual may meet the relationship test

Q80: Jaime recently found a "favorable" trial-level court

Q92: Common examples of sin taxes include the

Q97: Caitlin is a tax manager for an

Q98: If Julius has a 32 percent tax