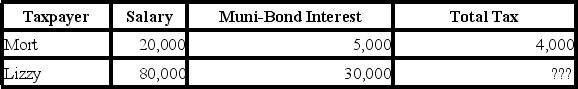

Given the following tax structure,what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Genetic Drift

A mechanism of evolution that causes allele frequencies within a population to change randomly with time due to chance events.

Natural Selection

A process by which species evolve over time as individuals with traits more suited to their environment are more likely to survive and reproduce.

Adaptive Evolution

The process through which populations become better suited to their environment through changes in genetic traits.

Nonadaptive Evolution

Evolutionary changes that occur without improving the biological fitness of an organism, often due to genetic drift.

Q3: Processes that occur without oxygen are called

Q12: What would occur in the capillary bed

Q12: Rod-shaped bacteria are called _.

Q16: Qualified dividends are taxed at the same

Q24: A patient's laboratory report shows that the

Q26: One key characteristic of a tax is

Q30: The heart's skeleton<br>A) electrically insulates the ventricles

Q30: What occurs in the descending limb of

Q62: The goal of tax planning is tax

Q117: The standard deduction amount for married filing