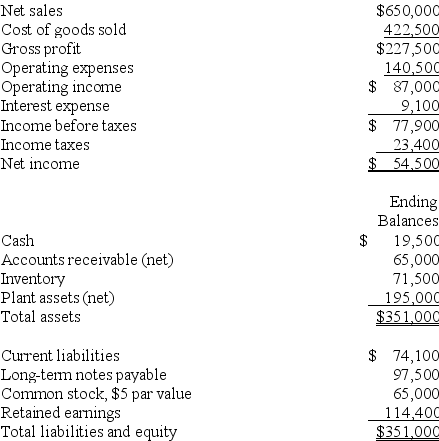

A company's calendar-year financial data are shown below.The company had total assets of $339,000 and total equity of $144,400 for the prior year.No additional shares of common stock were issued during the year.The December 31 market price per share is $49.50.Cash dividends of $19,500 were paid during the year.Calculate the following ratios for the company:

(a)debt ratio

(b)equity ratio

(c)debt-to-equity ratio

(d)times interest earned

(e)total asset turnover

Definitions:

Profit Margin

A financial ratio representing the percentage of revenue that remains as profit after all expenses have been deducted.

ROA

Return on Assets; a financial ratio indicating the profitability of a company relative to its total assets.

Total Assets

The combined value of all owned resources that have economic value and can provide future benefits to the business.

Return On Assets

A profitability ratio that measures how efficiently a company uses its assets to generate profit.

Q1: Both the direct and indirect methods yield

Q14: Which ribs attach to the sternum?<br>A) The

Q20: The background on a company,its industry,and its

Q29: The skeleton that includes the femur,humerus,phalanges,and clavicle

Q80: The statement of changes in stockholders' equity:<br>A)Is

Q135: The current ratio is calculated as current

Q143: Trend analysis of financial statement items can

Q160: The indirect method for the preparation of

Q176: Companies have the option of using either

Q203: Use the following information to calculate