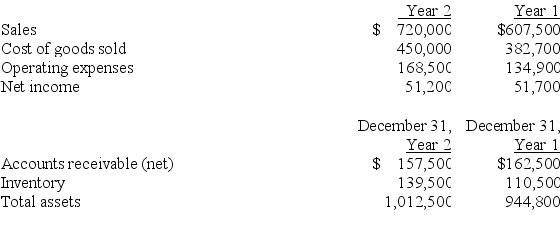

Comparative calendar-year financial data for a company are shown below.Calculate the following ratios for the company for Year 2:

(a)accounts receivable turnover

(b)day's sales uncollected

(c)inventory turnover

(d)days' sales in inventory

Definitions:

Counterparties

The other organization or party involved in a financial transaction or agreement.

Swap

A derivative contract through which two parties exchange financial instruments, typically involving cash flows based on a notional principal amount.

Floating Rate Debt

A type of debt instrument with a variable interest rate that adjusts periodically based on a benchmark interest rate or index.

Risk-Free Rates

The theoretical rate of return of an investment with no risk of financial loss, typically represented by the yield on government securities.

Q2: In growing children,a layer of cartilage called

Q10: Tissues are categorized into four main groups

Q20: Stated value of no-par stock is:<br>A)Another name

Q38: The central,shaftlike portion of a long bone

Q66: Prior to September 30,a company has never

Q90: Dividend yield is defined as the annual

Q123: Based on the information provided below for

Q179: A company's transactions with its creditors to

Q195: Lafferty Corporation reported earnings per share of

Q198: The current year-end balance sheet data for