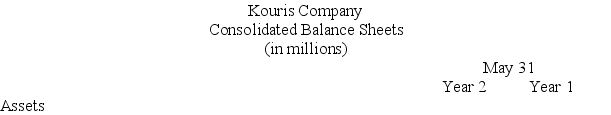

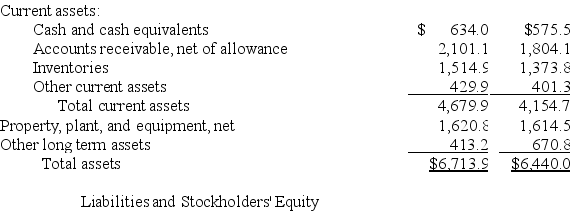

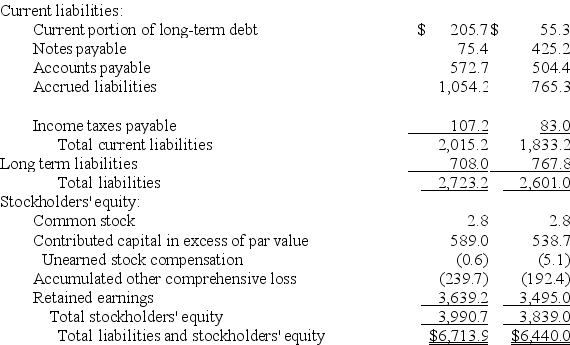

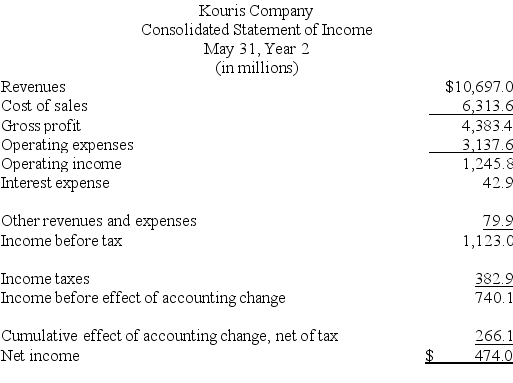

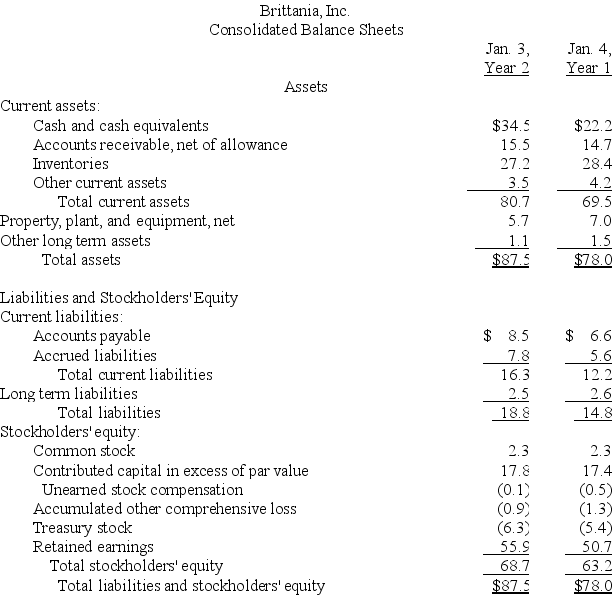

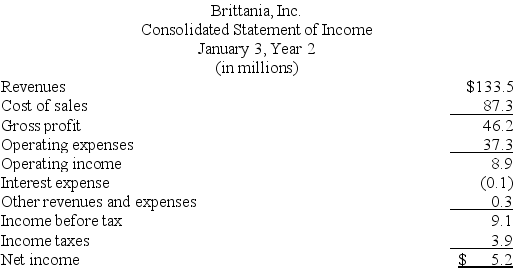

The following summaries from the income statements and balance sheets of Kouris Company and Brittania,Inc.are presented below.

(1)For both companies for Year 2,compute the:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies for Year 2,compute the:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Trading To Available-For-Sale

The process of reclassifying a security from being actively traded to being held with the intention not to sell in the near term.

Comprehensive Income

The total change in equity for a reporting period other than from transactions with owners, including all non-owner changes in equity such as unrealized gains and losses.

Fair Value

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Trading Securities

Financial instruments that are bought and sold for the purpose of generating profits on short-term fluctuations in price.

Q4: The number of shares that a corporation's

Q5: The end of the muscle that attaches

Q6: A noncash investing transaction should be disclosed

Q15: Information to prepare the statement of cash

Q24: The medullary cavity in most adults is

Q32: A company has $2,400,000 in stockholders' equity

Q97: The purchase of stock in another company

Q226: Babson reported assets of $13,362 million at

Q230: Use the following information to calculate cash

Q231: The current ratio and acid-test ratio are