A company issued 10%,10-year bonds with a par value of $1,000,000 on January 1,at a selling price of $885,295 when the annual market interest rate was 12%.The company uses the effective interest amortization method.Interest is paid semiannually each June 30 and December 31.

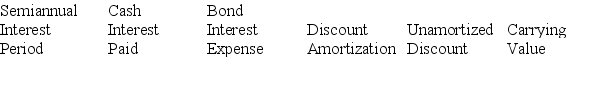

(1)Prepare an amortization table for the first two payment periods using the format shown below:

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Definitions:

Efficient

Efficiency refers to the optimal production and distribution of resources in a way that best meets the needs and desires of consumers.

Scarce Resources

Natural, human, and capital resources that are limited in supply and can be used for the production of goods and services.

Bowed Outward

Refers to the shape of a production possibility frontier that indicates increasing opportunity costs for producing two goods.

Opportunity Cost

The cost of foregone alternatives; the value of the best alternative given up when a decision is made to choose one option over another.

Q29: Companies may use a special bank account

Q43: Promissory notes that require the issuer to

Q82: A reverse stock split increases the par

Q88: What are methods that a company may

Q108: Uncertainties such as natural disasters are:<br>A)Not contingent

Q128: The following information is available for the

Q129: Bonds that have interest coupons attached to

Q142: Companies that have a relatively large amount

Q182: A company purchased a mineral deposit for

Q209: Obligations due within one year or the