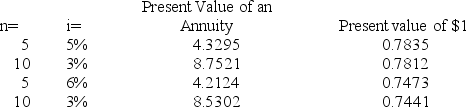

Sharmer Company issues 5%,5-year bonds with a par value of $1,000,000 and semiannual interest payments.On the issue date,the annual market rate for these bonds is 6%.What is the bond's issue (selling) price,assuming the following factors:

Definitions:

Order Size

The quantity of goods a company purchases or produces in a single order to meet its demand while minimizing costs.

Disaster Risk

The likelihood of loss of life, injury, or destruction and damage from a disaster in a given period.

Suppliers

Entities that provide goods or services to another entity, typically within a supply chain, to assist in the production of final products or services.

Expected Monetary Value

A statistical technique in decision-making that calculates the average outcome when the future includes scenarios that may or may not happen.

Q5: A discount reduces the interest expense of

Q20: Sales Taxes Payable is credited when companies

Q64: Explain how the cash flows from operating

Q155: Noncash financing and investing activities are disclosed

Q160: Extraordinary repairs are expenditures extending the asset's

Q175: During June,Vixen Company sells $850,000 in merchandise

Q188: Martinez owns an asset that cost $87,000

Q207: A change in an accounting estimate is:<br>A)Reflected

Q219: When the contract rate is above the

Q247: A company's property records revealed the following