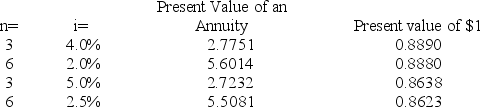

On January 1,a company issues bonds dated January 1 with a par value of $200,000.The bonds mature in 3 years.The contract rate is 4%,and interest is paid semiannually on June 30 and December 31.The market rate is 5%.Using the present value factors below,the issue (selling) price of the bonds is:

Definitions:

Research Objectives

The specific goals that guide a research project, defining what the researcher aims to discover or achieve.

Measurable

Capable of being quantitatively assessed or determined.

Marketing Research Approach

A systematic approach in marketing that involves gathering, analyzing, and interpreting information to help identify marketing opportunities and solve marketing challenges.

Develop Findings

The process of analyzing data or evidence from research or investigations to generate conclusions or actionable insights.

Q28: Return on equity increases when the expected

Q100: Return on equity increases when the expected

Q116: The use of debt financing ensures an

Q126: _ bonds have an option exercisable by

Q144: The term restricted retained earnings refers to

Q154: Star Recreation receives $48,000 cash in advance

Q172: If the dividends account is not recorded

Q186: Carson Company faces a probable loss on

Q221: A company purchased equipment for $65,000 with

Q227: A company issues 9%,5-year bonds with a