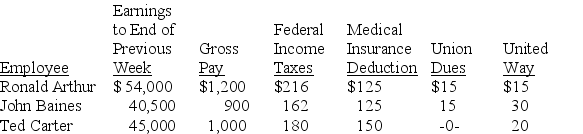

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Definitions:

Negligence

Guilty of neglect; lacking in due care or concern; act of carelessness.

Federal Law

Legislation enacted by Congress and signed by the president.

Legislation

Laws that have been passed by a governing body or the process of making or enacting laws.

Licensing Rules

Regulations and guidelines that govern the process of obtaining official permission to operate businesses or perform certain professions.

Q1: On April 1,a company issues 6%,10-year,$600,000 par

Q7: Explain how to record the receipt (acceptance)of

Q29: The contract rate on previously issued bonds

Q51: Gain or loss on the disposal of

Q82: For legal reasons,it is not advisable to

Q131: A corporation is responsible for its own

Q185: _ is a general term that refers

Q218: The process of allocating the cost of

Q223: A 10-year bond issue with a $100,000

Q248: A benefit of using an accelerated depreciation