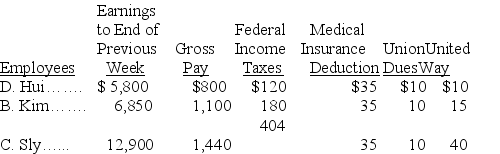

The payroll records of a company provided the following data for the current weekly pay period ended March 12.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Definitions:

Poverty

A condition where individuals or communities lack the financial resources to meet basic living needs such as food, shelter, and healthcare.

Percent

A ratio or fraction expressed as a part of 100.

Ethnic Minorities

Groups within a community, nation, or state which have different national or cultural traditions from the majority population.

Immigration

The action of coming to live permanently in a foreign country, often involving changes in social identity and cultural adaptation.

Q20: Owning a patent:<br>A)Gives the owner the exclusive

Q45: The Branson Company uses the percent of

Q45: A bank that is authorized to accept

Q51: A company issued 7%,5-year bonds with a

Q99: The deferred income tax liability:<br>A)Arises when income

Q140: Which of the following statements regarding increases

Q166: Jasper makes a $25,000,90-day,7% cash loan to

Q188: Companies with many employees often use a

Q191: The expense recognition (matching)principle permits the use

Q219: Explain the purpose of and method of