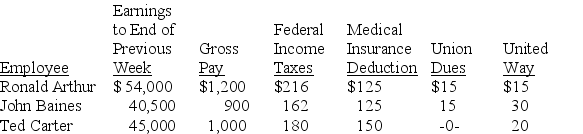

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a)accrue the payroll and (b)record payroll taxes expense.

Definitions:

Strike Replacements

Workers hired by an employer to perform the duties of striking employees during a labor strike.

Bargaining Unit

A group of employees with a clear and identifiable community of interests who are represented by a single labor union in collective bargaining.

Industrial Unionism

A labor union organizing method where all workers in the same industry are unified into a single union, regardless of their specific trades or professions.

Social Unionism

A form of unionism focused on broader societal issues beyond workplace concerns, including social justice, environmental sustainability, and community welfare.

Q11: On January 1,Year 1 a company borrowed

Q27: Uniform Supply accepted a $4,800,90-day,10% note from

Q55: The _ concept is the idea that

Q59: Betterments are a type of capital expenditure.

Q118: Required payroll deductions include income taxes,Social Security

Q144: A high accounts receivable turnover in comparison

Q164: Accounting for contingent liabilities depends on the

Q184: When a note receivable is dishonored,it reverts

Q190: A company purchased store equipment for $4,300

Q222: The following information is available on a