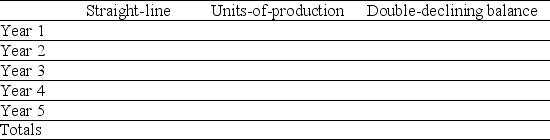

A company purchased a machine on January 1 of the current year for $750,000.Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours,with a salvage value of $75,000)using each of the below-mentioned methods.During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Definitions:

Q9: A building was purchased for $370,000 and

Q10: A machine with an original cost of

Q20: Umber Company's bank reconciliation for September is

Q31: Gideon Company uses the direct write-off

Q58: The following account balances are taken from

Q61: Describe contingent liabilities and how to account

Q75: When originally purchased,a vehicle costing $23,000 had

Q152: The following information is available to reconcile

Q184: When a note receivable is dishonored,it reverts

Q205: Goods on consignment are goods shipped by